Maintenance Plan Process

Contact an account manager

Back to all articles

Back to all articles

Banks, Financial institutions, and insurance agencies moved to digital ways of doing business that resulted in the inception and development of Fintech. It is commonly referred to as Financial tech, hence the products such as banking apps, banking platforms, and finance software systems are the product of this amazing technology.

Now financial services have broadened its horizon to cryptocurrency, Robo-advising, crowdfunding, blockchain, fintech payment gateways. Financial services combined with the latest technologies and technological tools bring new opportunities for investment, financial infrastructure, Insurance agencies, and banks in general.

Hold On, Don't go away yet!

We know this is a lot of jargon to absorb at once. So, we have decided to break it down in a simpler and easier to understand way with this guide.

Let's begin!

Can you imagine traveling miles and miles to go to an urban setting in order to visit a bank? No, because now you can access everything at just one click. It has been made easier and simpler with help of technologies. The financial services are no longer reliant on traditional methods, they are more focused on user’s convenience.

With the rise in fintech and its growing need, there are a lot of applications and possibilities on the horizon. It has made it easier to automate the financial process through digital platforms, software systems, and apps. Do you know? There is a 64% rise in the adoption of financial technology services. But the real question is, are you ready for this change?

Because we are, who wouldn't want an easier way to deal with finance, taxation, and investment? There are numerous benefits of fintech that are already making waves.

So what do you think? Are you thinking about venturing into the financial technology market?

Its never too late, so don't wait up!

Take the next step to turn your idea into reality!

There different areas within the financial services and banking market, where we can find incredible solutions. It involves:

The dynamics are changing at a global level, that are helping to create innovative solutions. Top market players are thrilled to see this transformation because it is changing the way businesses use to operate. It is also an undeniable fact that tech-savvy consumers are also putting forward the demand for these tech-backed smart tools and solutions.

With the market becoming larger every day as it's saturated with new applications. The future seems to be very much dependent on new technological advancements because of the new generations like less physical interaction and more digital ways to handle payments, billing, and selling. The smarter solutions laden with regulations and laws are essential to maintain transparency, security, and ease.

Regtech is the term, that is becoming a buzzword within the fintech community. Because compliance software to check regulations to maintain security will be needed. As we move forward, it won't be humanly possible to organize, manage, or regulate data without automated software systems.

But we are curious about the technologies that are playing the role of “game-changer” to bring such phenomenal solutions. The surge in the blockchain is also part of the same ladder, and it is predicted that it will impact multiple industries. Experts and companies are harnessing the full power of these technologies to provide solutions that offer:

Finance in combination with technology holds a bright future, and it will continue to grow and evolve into better solutions. With the help of the latest technologies, we can harness the real power of data and manage the assets. It is important to discuss the environmental benefits and save up costs. The extra spending on resources, infrastructure expenditures can be reduced to nothing once you've developed digital tools to manage everything. It applies to all kinds of assets whether its financial documents or confidential data.

Countries are fully vested and moving towards creating more tech-based financial services. As you can in the below percentages that Chinese and Brazilian companies are utilizing emerging technologies for financial services. While the US and Germany are still on their way to adapt fintech strategies and to inculcate the models that suit them.

| Organizations ( Country based) | Adaptation of Fintech Mode |

| China | 58% |

| Brazil | 55% |

| US | 37% |

| Germany | 36% |

After years of experience and competition, we are at the crossroads where everything seems to be colliding for the benefit of everyone. After the technology disruption and information surge, we have to streamline strategize and define smart models for solutions.

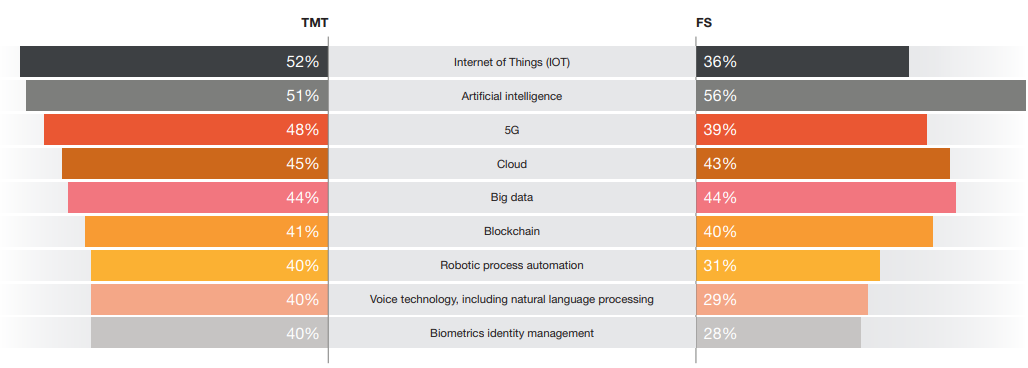

With the rise in tech based finance solutions and IoT combined with Artificial intelligence seems to be dominating the IT market. A recent survey on the fintech industry revealed that financial organizations are hiring 73% of its resources from the information technology sector.

If you want to start your own journey, now is the best time to jump in the pool. But if you are looking for any unique solutions as per your business needs. Please tell us here!

Commitment to excellence